China’s State-owned Enterprises Rise as Private Companies Face Collapse in Real Estate Turmoil

China’s real estate market is undergoing a crisis with sluggish sales and a slow economic recovery. Meanwhile, Chinese state-owned enterprises (SOEs) are rapidly gaining dominance in real estate sales, while private companies, including giants like Evergrande Group and Country Garden, face looming debt defaults. This power shift is raising questions concerning the Chinese regime’s intent to expand the SOEs and its implications for the broader economy.

This phenomenon in the Chinese economy gave rise to the catchphrase, “The state enterprises advance, the private sectors retreat,” meaning that the SOEs are expanding and forcing out private companies. The regime would generally favor SOEs in policies and subsidies and, therefore, gradually eliminate competitors from the market. This trend signals that China’s real estate power landscape is facing a major reshuffling. Real estate contributes to around 30 percent of China’s GDP and is, therefore, critical to the stability of the country’s economy.

Data shows that the total sales of China’s top 100 real estate companies from Jan. to Oct. amounted to 4.56 trillion yuan (US$624.7 billion), a decrease of 12.8 percent compared to the same period last year. The top five companies on the sales list were dominated by SOEs backed by the Chinese Communist Party (CCP).

Topping the sales list was Poly Real Estate, a subsidiary of the state-owned China Poly Group, whose sales from Jan. to Oct. rose 1.4 percent year-on-year to 368.21 billion yuan (US$50.4 billion). This amount is 6.7 times that of 22nd-ranked China Evergrande’s 54.6 billion yuan (US$7.5 billion).

In the second to fifth place on the sales list, all are SOEs, and three out of four of them had increased their sales volume in the past year.

In China’s real estate sales rankings from Jan. to Oct., the pattern of the top 100 real estate companies is undergoing a complete remake. Country Garden, a privately owned company, fell out of the top five and ranked sixth, with its sales volume plummetting 49.3 percent year-on-year. Another private property developer, Sunac China, saw their sales plunge the most year-on-year by 50.5 percent among the top 50 companies.

The real estate SOEs’ sales performance is even more remarkable in the land market. The amount of land ownership is a crucial resource for real estate companies to develop, which determines their future market share. However, due to the limited capital strength and the downturn of the Chinese real estate industry, the once-large private companies are no longer in a position to acquire more land. The CCP’s state-owned real estate companies are taking advantage of the situation to take control of high-quality land resources.

According to data from January to the end of October, among the top 100 Chinese real estate companies, nearly 50 percent of them have almost stopped acquiring land, and most of these real estate companies are ranked in the lower half of the top 100 in terms of sales performance.

The top ten real estate companies in land acquisition are all SOEs controlled by the CCP. SOEs also accounted for 66 percent of the land acquisitions, while private Chinese companies only accounted for 22%. This shows that the future dominance of China’s real estate market will be in the hands of these SOEs.

Mike Sun, a North American investment consultant, spoke to The Epoch Times: “Seeing the difficulties experienced by private real estate companies, the SOEs seized the opportunity to acquire land for two major reasons. First, they wish to stabilize the market by having the CCP own most of the land in the country. The regime certainly does not want to see their land depreciate in value.

Secondly, the SOEs have not suffered significant losses during the real estate crisis. So they are taking advantage of the decline of the private companies to accelerate their goal of expanding state ownership at the expense of privately owned companies, thus achieving dominance in the real estate power map.”

Mr. Sun believes that the economic development model led by real estate development and urbanization since 1998 has come to an end and that the collapse of the real estate sector is inevitable.

Since the second half of 2021, property prices in China have continued to fall, breaking the previous market trend of only rising prices. China’s economy has also been on a downward trend, with the youth unemployment rate hitting record highs at 21.3 percent in July. Some academics suggest that the actual figure could be as high as 46.5 percent. The real estate crisis in China is also starting to impact the financial sector, which may lead to a broader economic crisis.

Comments

Italy is overtaking Germany as Europe's economic powerhouse

Lawmakers urge Biden to call out more Chinese biotech firms

Gaza death toll crosses 33,000

US court orders exiled Chinese billionaire Guo Wengui to face fraud indictment

Hong Kong's lost freedom shows Xi Jinping's priorities: Analysis

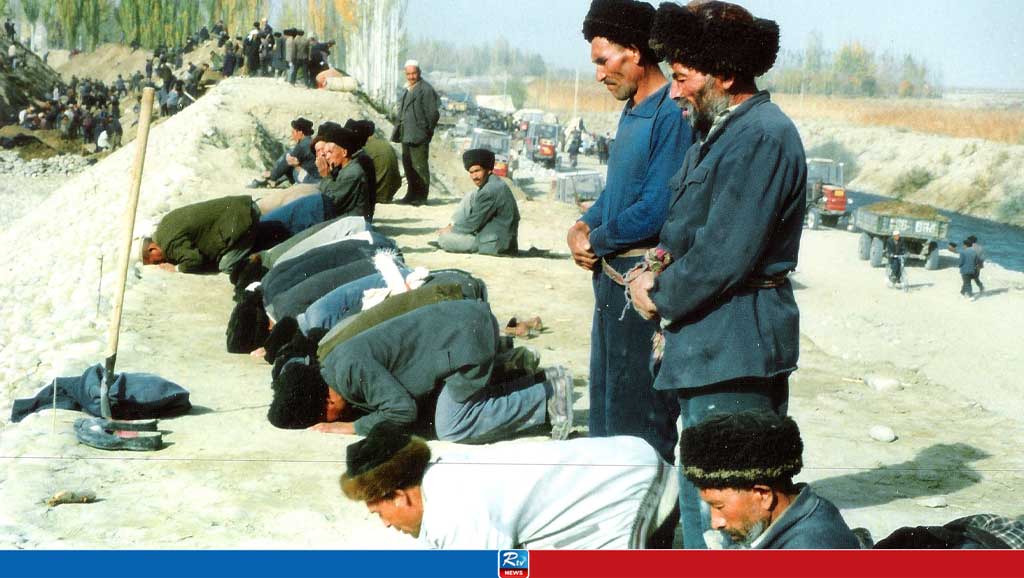

All people of faith should stand against China’s Uyghur genocide

Climate activist Greta Thunberg arrested in the Netherlands

Live Tv

Live Tv