Products price that may decrease

Finance Minister Abu Hena Mohammad Mustafa Kamal revealed the national budget of total TK. 7,61,785 crore for the fiscal year 2023-24 in the national parliament.

On Thursday, June 01, Finance Minister Mustafa Kamal presented the proposed national budget under the chairmanship of the National Parliament Speaker Shirin Sharmin Chaudhury and in the presence of Prime Minister Sheikh Hasina.

In this budget, finance minister proposed the price reduce of several items including sweets, soap, shampoo, meat, and agricultural products.

To encourage local production, it has been proposed to reduce 10-15% custom duty and supplementary duty on local product. This can lead to decrease of locally produced LED bulb and socket price.

In the proposed budget, a 5% VAT exemption has been granted on sales made by e-commerce companies. As a result, their delivery charges will be reduced.

In the budget, the government can give duty concession on raw materials import for the production of more medicines and medical equipment. Raw materials import for anti-cancer and anti-diabetes drugs will be brought under duty waiver.

The locally produced agricultural machinery and machinery manufacturing equipment price may come down due to the tariff concession in budget. It may reduce or exempt the import duties on luxury foreign apparel in this budget.

According to NBR, customs duty on these products can be reduced from 20-25% to 5-10%. As a result, if the duty on luxury clothes is reduced, then these clothes will be available at lower prices.

NBR sources said, "In order to boost local production and support further development of related industries, government may continue VAT exemption on raw materials for Menstrual pad and diapers till June 30, 2024.

The 5% VAT facility of soap and shampoo raw material may be extended for one more year.

In this year's budget, there may be a proposal to bring meat and meat products into the category of daily commodities. The main objective is to reduce the price of products that are beyond the reach of the lower and middle class.

Income tax on these goods may be reduced 7% to 2%.

Comments

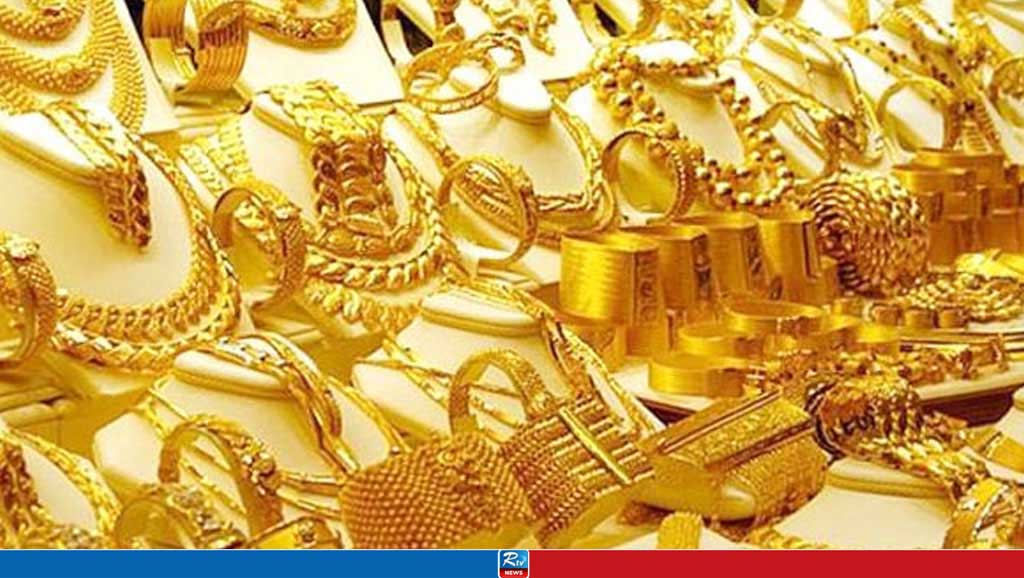

Gold prices hitting record high, breaks all records

Eid shopping reaches its peak

More than 2m SIM card holders left the capital in 2 days

Moon not sighted, Eid on Thursday

16 lives lost in road crash across country

Metro Rail to remain closed for 2 days during Eid

Moon sighted, Eid on Thursday

Live Tv

Live Tv