Indian startups chase surge in retail investors

Sonam Srivastava used to create trading algorithms for high-frequency securities traders. But when the U.S. advisory she worked for scrapped plans to launch in India, she decided to start her own advisory business in Mumbai. In 2019, she began offering stock portfolio recommendations on a site called Smallcase, which executes trades on investors' behalf.

Srivastava's recommendations became popular among retail investors during the COVID-19 pandemic. Starting with a "multifactor" strategy based on quantitative research, she has added new themes such as "momentum," which aims to take advantage of a bull market, and another focused on small-cap stocks.

Today, about 6,500 customers have invested nearly 1 billion rupees ($13 million) through Smallcase, Srivastava said in an interview. Most of her clients are "aggressive millennial investors aged 25 to 40, predominantly male, and come from the tier-one and tier-two cities," she added.

Srivastava and Smallcase are part of a major shift in India's wealth management industry. Retail investors, once a relatively small force, compared with foreign and domestic institutions, have grown rapidly since the start of the pandemic, helping drive stock prices to record highs. Economists at the National Stock Exchange (NSE) of India said the share of individual investors on the NSE by turnover rose from 33% in the 2016 fiscal year to 45% in fiscal 2021.

The number of individual demat accounts, which keep an electronic record of securities that investors are required to have to trade stocks, rose from 39.5 million in January 2020 to 77.2 million in November 2021. For all of 2019, the number of new accounts created totaled just 4.5 million. The trading boom has been fueled by a string of large initial public offerings in India's technology sector, such as food delivery company Zomato, and One97 Communications, owner of mobile payments app Paytm. Economists also attribute the growth in stock trading to a shift to high-yield investments amid falling interest rates.

Among those betting on the Indian stock market is Debnarayan Banerjee, a 36 year-old information technology professional at a U.S.-headquartered multinational. Banerjee, who lives in Bangalaru, had been parking money in mutual funds for about five years when the COVID-19 pandemic struck in early 2020. His investments were intended to create a nest egg for his toddler's education as well as his retirement. He was also paying monthly installments for an apartment and a car he bought right before the pandemic struck.

Yet when India's stock market plunged in early 2020, Banerjee more than doubled his investments instead of cutting back. "Investing in stocks or mutual funds is a long-term play," says Banerjee. "It was an opportunity to buy more in the dip."

Now competition among startups to capture business from tech-savvy millennial investors is heating up. Venture capital firms have poured money into online brokerage startups like Groww and Upstox, both of which were reportedly valued at more than $3 billion in fundraising rounds in 2021. Zerodha, considered larger than those two competitors, with 7.5 million active users, has not raised capital during the pandemic.

Smallcase is an online marketplace that offers portfolios of stocks and exchange traded funds by licensed investment advisers. The company hopes to meet demand among investors who want to build a diverse portfolio of stocks but do not want to passively invest in mutual funds.

"The challenge in India has been that there would only be two ways for people to invest: Either they invest into a mutual fund, or they start picking their own stocks and build their own portfolios," said Vasanth Kamath, Smallcase's founder and CEO. "Smallcase is a great gateway in between because it gives you a portfolio approach to investing into equities, but the experience is also very simple."

Founded in 2015, Smallcase had 500,000 customers in January 2020, but that number jumped to 4 million during the pandemic, according to Kamath. The company held a $40 million funding round in August with a group of investors that included Amazon. But competition is only intensifying. WealthDesk, a portfolio investment startup founded in 2016, began offering products on Paytm's stock trading app in September.

Kamath said he is looking to expand Smallcase's offerings into new categories, such as bonds, and potentially cryptocurrency, if the regulatory environment becomes clearer.

India's benchmark Sensex stock index dropped 34% between January and March 2020, but has since risen by about 110%. Some analysts have warned that the dramatic influx of new retail investors means valuations are overheating. After reaching an all-time high in October, the Sensex has declined by about 7%. The increase in the number of new demat accounts hit a peak of 3.58 million in October and fell slightly in November.

"As active retail participants increased substantially, the overall market delivered a positive return of over 15% despite foreign investor outflows of more than 800 billion rupees in 2021," said Mitul Shah, head of research at Reliance Securities. "The recent correction certainly makes investors start thinking about fundamentals, the economy and valuations. The stock market is already trading at a 10% to 15% premium to its historical average valuation of 17 times [the] one-year forward price-to-earning ratio, which creates some discomfort on the valuation front."

Whether investors will stay after a market downturn "is something that all the entire industry is obviously thinking about, and we have no right answer," Kamath said. "But I think there is a strong undercurrent of something changing fundamentally in how people think about asset allocation."

Source: NIKKEL ASIA

Comments

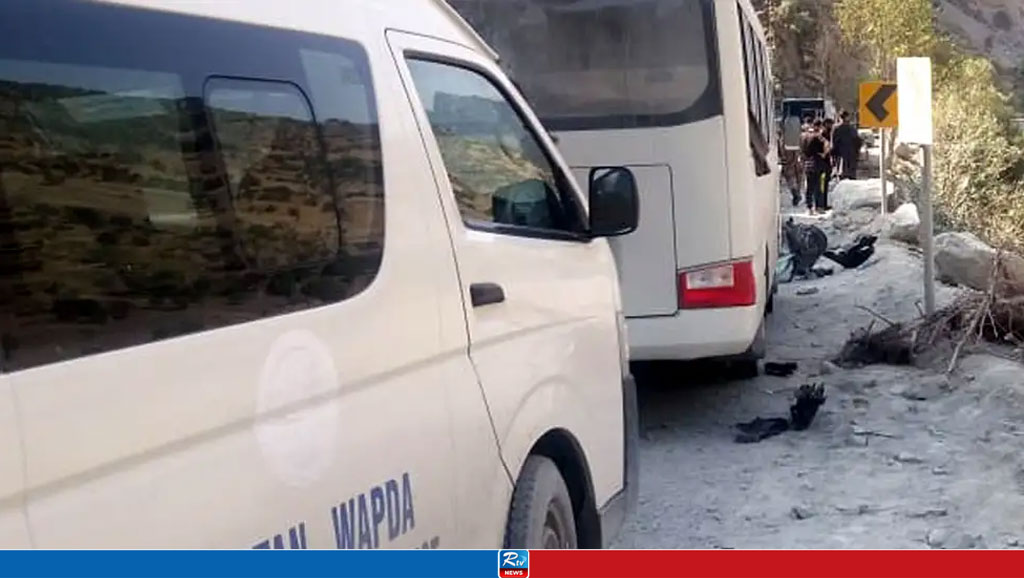

5 Chinese workers killed in bombing

Japan's yen dips to 34-year low against US dollar

Decoding China’s Neo-Colonist practices in Africa

Jacob Zuma barred from running in election

45 dead in South Africa bus crash, 8-year-old girl only survivor

World's most expensive cow sold for $4.3 million in Brazil

Turkey: Polls close in Erdogan's 'last election'

Live Tv

Live Tv