India’s largest-ever foreign currency bond issuance: RIL raises $4 billion

While the $1.5 billion notes priced at 2.875% mature in ten years in 2032, the $1.75 billion notes priced at 3.625% mature in 30 years in 2052, and the $750 million notes priced at 3.750% mature in 40 years in 2062.

Moody's, that issued a 'Baa2' rating with a stable outlook to the latest RIL bonds, believes that the company's earnings will continue to improve over the next 12-18 months across all its business segments, such that its credit metrics will remain strongly positioned for its ratings.

Reliance Industries (RIL) on Thursday said it has raised $4 billion in India’s largest-ever foreign currency bond issuance. The multi-tranche bonds were oversubscribed three times. The company said, proceeds from the issuance will be used to refinance high-cost borrowings.

The three tranche bonds have a maturity of 10-year, 30-year and 40-year, and were 120 basis points (bps), 160 bps and 170 bps over the respective US Treasuries benchmark, the company said in a statement.

While the $1.5 billion notes priced at 2.875% mature in ten years in 2032, the $1.75 billion notes priced at 3.625% mature in 30 years in 2052, and the $750 million notes priced at 3.750% mature in 40 years in 2062.

This is the first time any private company rated ‘BBB’ from Asia ex-Japan has achieved lowest coupon for 30-year and 40-year issuances. Also, it is the “first-ever 40-year tranche by a BBB private sector corporate from Asia ex-Japan,” RIL said.

The bonds received orders from over 200 accounts in Asia, Europe and the United States, RIL said. Srikanth Venkatachari, joint chief financial officer of RIL, said, “The support received from the marquee international capital market investors is reflective of the strength of our underlying businesses with established growth platforms across energy, consumer and technology as well as robustness of our balance sheet.”

RIL last year announced an investment of Rs 75,000 crore to improve its clean energy footprint and become carbon neutral by 2035. To that effect the company is setting up five giga factories in the renewable energy space in Jamnagar, Gujarat and has already invested into five clean technology companies in the last six months.

As of September 30, 2021, the company had adjusted cash and cash equivalents, including quoted marketable securities, of about Rs 1.9 lakh crore ($25.6 billion). “Its existing cash, along with expected cash flows from operations, will be sufficient to cover its cash outflows for capital spending and debt maturities in the next 18 months,” Moody’s said.

RIL’s adjusted net debt/Ebitda (operating profit) was estimated at around 1.1 times as of September 30, 2021. The rating downgrade trigger happens when net debt/Ebitda reaches 3.0 times. Moody’s expects the company to generate sufficient cash flows from operations each year to fund its capital spending.

Source: Financial Express

Comments

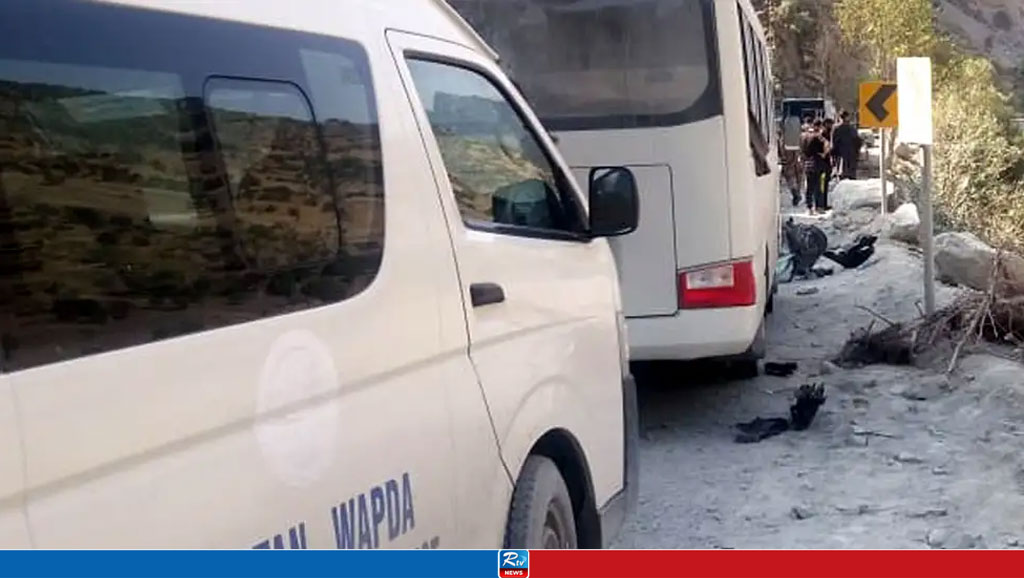

5 Chinese workers killed in bombing

Japan's yen dips to 34-year low against US dollar

Decoding China’s Neo-Colonist practices in Africa

Jacob Zuma barred from running in election

45 dead in South Africa bus crash, 8-year-old girl only survivor

World's most expensive cow sold for $4.3 million in Brazil

Turkey: Polls close in Erdogan's 'last election'

Live Tv

Live Tv