Private investment to pick up: CEA of India

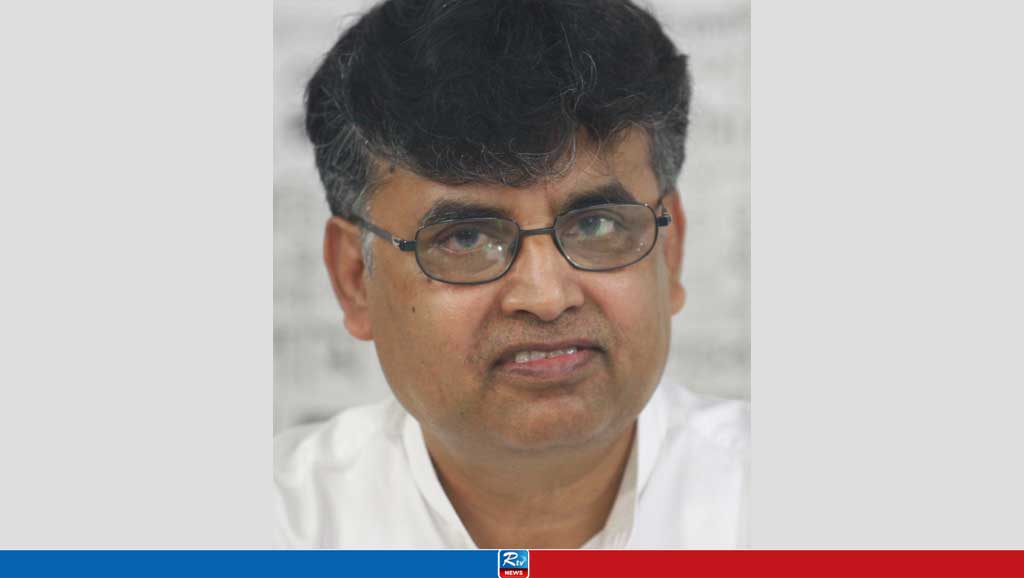

The long elusory private investment is reviving and getting new pace after the pandemic sponsored uncertainties melting considerably, chief economic advisor (CEA) Krishnamurthy V Subramaniam told The financial express in an interview.

Companies cut costs, recorded profitability and have deleveraged, partly supported by a much-needed corporate tax rate cut just months before the pandemic began. So, the ability of the companies to start fresh investments remains strong, Subramanian said.

However, it’s also a “simple fact” that in times of great uncertainties, private investments take a knock, as firms take a wait-and-watch approach. But there is huge scope for improvement, he explained. Gross fixed capital formation grew 11% in the September quarter. Meanwhile, private consumption of goods and services, the most critical pillar of the economy, has grown this fiscal even when spending avenues remained limited due to localized curbs, he added.

As the manufacturing sector remains strong and the services sector gains momentum with greater headway in the vaccination drive, as reflected in the Purchasing Managers’ Index, private consumption of goods and services, too, will recieve further boost in the coming months, the CEA said. In fact, India’s manufacturing growth over a five-year period (through 2019) piped China’s for the first time since 1990s, he said.

As the government decides to bring in a crypto currency Bill in the ongoing Winter session of Parliament, the CEA endorsed the official position that private cryptocurrencies shouldn’t get legal tender status. Even granting legal status to the private crypt currency holder is fraught with risks at this point, and any such decision, if at all it’s made, must be followed careful examination, he said.

This is because a cryptocurrency doesn’t derive its value from any underlying assets or earnings nor does it add to real economic activities, he conceded. So, the valuation can be easily swayed with speculative bids, causing excessive volatility. Retail investors, especially the small ones, would struggle to cope with such wild fluctuations. For instance, as some analysts have pointed out, the value of Bitcoin crashed from $20,000 per coin in December 2017 to just $3,800 by November 2018, before rising again.

“As demand for investments rises up, loans to the corporate sector will also rise up significantly. Also, companies currently have deleveraged and are sitting on cash. Only when they exhaust their internal cash flow, they will go for borrowing,” he said.

Subramanian asserted that India doesn’t stare at a flight of capital in the wake of the taper tantrum in the US. The impact, at most, would be felt for a very short period, and won’t be wide-ranging, he added.

This is because the economy of India is on a solid footing now unlike in the aftermath of the 2008-09 global financial recession when three key indicators of macro-economy —inflation, current account balance and fiscal deficit — went highly downhill fast due to the UPA government’s excessive focus on stimulating only demand.

“In contrast, this time around, the V-shaped recovery that we had predicted last year did successfully happen and India has achieved the sharpest recovery among all economies. Comparing peer economies, Fiscal deficit of India is still lower than other economies. Inflation is less than 5% and I expect it to remain around that level for some more upcoming months, given the supply-side measures we have undertaken. Current account deficit, which has risen a bit of late, would still be well under control,” he said. So, India is doing very well on both macro-stability and growth fronts, and that is something global investors would keep in mind.

Source: The financial express.

Comments

Warehouse developers bet on India as companies look beyond China

US Diplomat Donald Lu denies Pushing Pakistani ex-PM Khan Out of Office

Spain: Judge orders Telegram to be blocked nationwide

More than 100 kidnapped schoolchildren rescued in Nigeria

Philippines supply ships clash with Chinese coast guard

China promoting Mandarin in parts of Tibet: Report

Nepal asks China to convert Pokhara airport loan into grant to ease financial burden

Live Tv

Live Tv